Under a key person disability income policy premium payments, businesses safeguard their financial well-being against unforeseen circumstances. Dive into this comprehensive guide to understand the intricacies of this crucial coverage, ensuring your key individuals and your business remain protected.

In this detailed exploration, we’ll delve into the factors influencing premium payments, coverage options, tax implications, and more. Empower yourself with the knowledge to make informed decisions and secure your business’s future.

Key Person Disability Income Policy

A key person disability income policy is a type of insurance that provides financial protection for a business in the event that a key employee becomes disabled and unable to work.

Key employees are those who are essential to the success of a business, such as the CEO, CFO, or other senior executives. If a key employee becomes disabled, it can have a significant impact on the business, including lost revenue, decreased productivity, and increased costs.

Benefits of a Key Person Disability Income Policy

- Provides financial protection for the business in the event that a key employee becomes disabled.

- Helps to ensure that the business can continue to operate smoothly and meet its financial obligations.

- Can help to attract and retain key employees by providing them with peace of mind.

Who Should Consider a Key Person Disability Income Policy?

Any business that relies on a small number of key employees should consider purchasing a key person disability income policy. This includes businesses of all sizes, from small startups to large corporations.

Some examples of businesses that may benefit from a key person disability income policy include:

- Businesses with a high concentration of revenue or profits generated by a small number of employees.

- Businesses that rely on the expertise or knowledge of a few key employees.

- Businesses that are in a highly competitive industry.

- Businesses that are in a start-up or growth phase.

Premium Payments

The premium payments for a key person disability income policy are determined by several factors, including the policyholder’s age, health, and occupation.

Age

Younger policyholders typically pay lower premiums than older policyholders. This is because the risk of disability decreases with age.

Health

Policyholders who are in good health typically pay lower premiums than those who have health problems. This is because the risk of disability is higher for those who have health problems.

Occupation

Policyholders who work in high-risk occupations typically pay higher premiums than those who work in low-risk occupations. This is because the risk of disability is higher for those who work in high-risk occupations.

| Risk Factor | Premium Rate |

|---|---|

| Age | Lower for younger policyholders |

| Health | Lower for policyholders in good health |

| Occupation | Higher for policyholders in high-risk occupations |

Coverage Options

Key person disability income policies offer various coverage options to tailor the policy to the specific needs of the insured individual and business. These options include choosing the definition of disability, benefit period, and waiting period.

Definition of Disability

The definition of disability determines the conditions under which the insured person is eligible to receive benefits. Two common definitions are:

- Own-Occupation Coverage:Benefits are payable if the insured person is unable to perform the material and substantial duties of their own occupation.

- Any-Occupation Coverage:Benefits are payable if the insured person is unable to perform any occupation for which they are reasonably suited, given their education, training, and experience.

Benefit Period

The benefit period specifies the duration for which the insured person can receive disability benefits. Common benefit periods range from two years to lifetime.

Waiting Period

The waiting period is the time between the onset of the disability and the commencement of benefit payments. Shorter waiting periods result in higher premiums, while longer waiting periods lower the premiums.

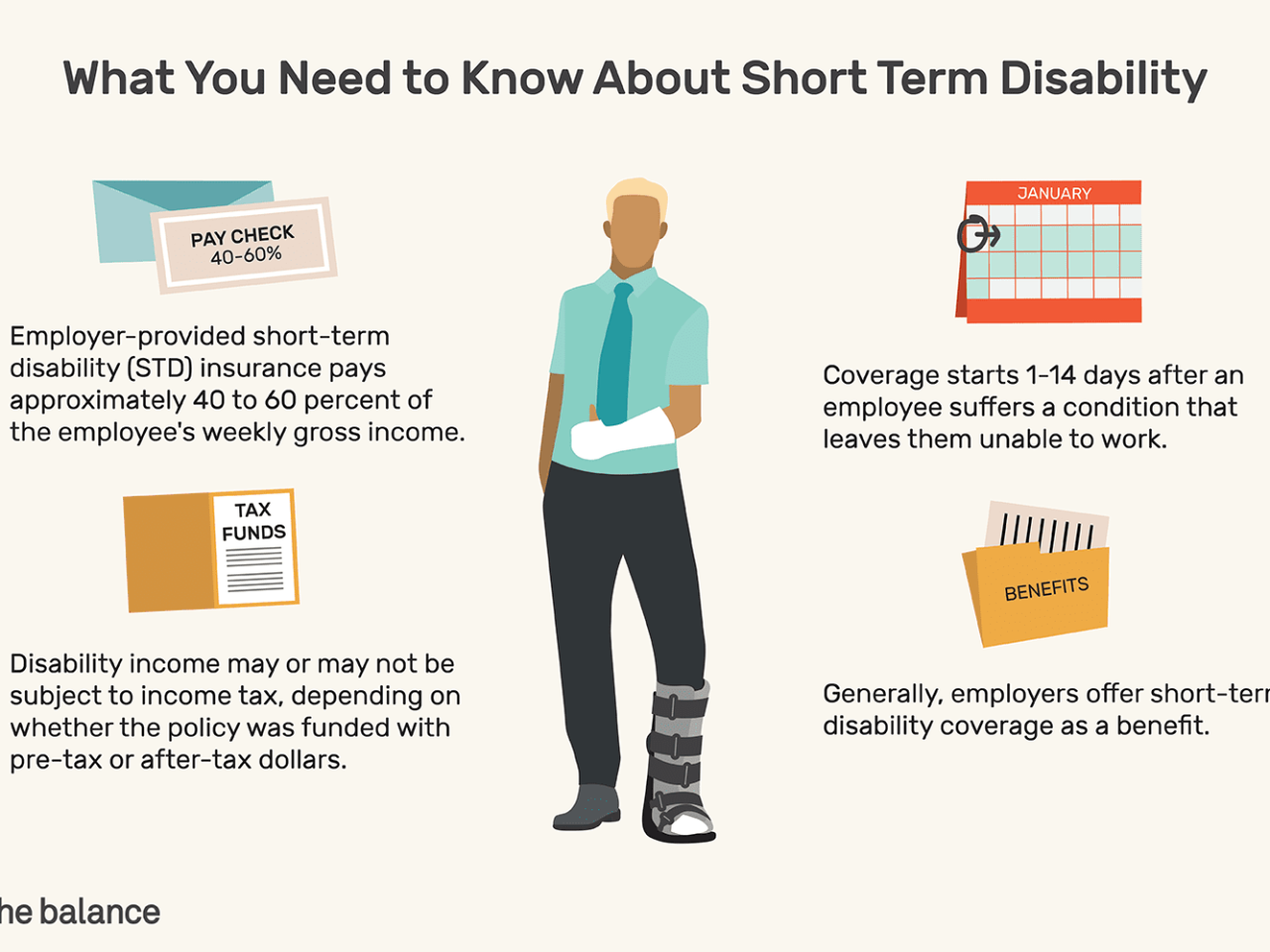

Tax Implications

The tax implications of key person disability income policies can be complex, but understanding them is crucial for policyholders. This section will explain the tax treatment of both premium payments and benefits received under the policy.

Premium Payments

For businesses, premium payments for key person disability income policies are generally tax-deductible as ordinary and necessary business expenses. This means that the business can reduce its taxable income by the amount of the premiums paid.

Benefits Received, Under a key person disability income policy premium payments

Benefits received under a key person disability income policy are generally taxable as ordinary income for the recipient. However, there are some exceptions to this rule. For example, if the policyholder has contributed to the policy with after-tax dollars, then a portion of the benefits received may be tax-free.

Tax Considerations

Tax considerations can significantly impact the policyholder’s decision-making. For example, a business may decide to purchase a policy with a higher premium in order to take advantage of the tax deduction. Alternatively, a policyholder may choose to contribute to the policy with after-tax dollars in order to receive tax-free benefits.

Riders and Endorsements

Riders and endorsements are additional provisions that can be added to a key person disability income policy to customize the coverage and meet specific needs. They can enhance the policy’s benefits, provide additional flexibility, or address specific concerns.

Common Riders and Endorsements

- Guaranteed Insurability Option:This rider allows the policyholder to increase the coverage amount in the future without providing evidence of insurability. This is particularly useful for individuals who anticipate their income will grow significantly over time.

- Cost-of-Living Adjustment (COLA) Rider:This rider automatically adjusts the coverage amount each year based on inflation, ensuring that the benefits keep pace with rising living costs.

- Future Purchase Option Rider:This rider gives the policyholder the option to purchase additional coverage in the future, regardless of their health status.

- Waiver of Premium Rider:This rider waives the premium payments if the policyholder becomes disabled, providing financial relief during a time of income loss.

- Return of Premium Endorsement:This endorsement provides a refund of premiums paid if the policyholder does not make a claim during the policy term.

Claims Process

When a key person becomes disabled and can no longer work, the claims process for a key person disability income policy is initiated. This process involves filing a claim with the insurance company and providing the necessary documentation to support the claim.

The insurance company will then review the claim and make a decision on whether to approve or deny it.

The following are the steps involved in filing a claim for a key person disability income policy:

- Contact the insurance company and request a claim form.

- Complete the claim form and provide all of the required documentation.

- Submit the claim form to the insurance company.

The following are some of the factors that can affect the approval or denial of a claim for a key person disability income policy:

- The definition of disability in the policy.

- The severity of the disability.

- The length of time the disability is expected to last.

- The claimant’s occupation and income.

- The claimant’s medical history.

- The claimant’s age and health.

Best Practices

To ensure the effectiveness and efficiency of your key person disability income policy, adhering to certain best practices is crucial.

First and foremost, it is highly recommended to collaborate with a qualified insurance professional who possesses in-depth knowledge of disability income insurance and can guide you through the complexities of selecting and managing a policy that aligns with your specific needs.

Key Considerations for Policyholders

When evaluating and managing a key person disability income policy, there are several key considerations that policyholders should keep in mind:

- Determine the appropriate level of coverage:Calculate the income that needs to be replaced in the event of disability and ensure the policy provides sufficient coverage to maintain the financial stability of the business and the key person’s family.

- Select the right benefit period:Consider the potential duration of a disability and choose a benefit period that aligns with the expected recovery time or retirement age.

- Choose the optimal waiting period:Determine the acceptable waiting period before benefits begin, balancing the need for immediate income protection with affordability.

- Understand the definition of disability:Carefully review the policy’s definition of disability to ensure it meets the specific needs of the key person and the business.

- Consider riders and endorsements:Explore additional coverage options, such as cost-of-living adjustments or return-to-work benefits, to enhance the policy’s protection.

- Review the policy regularly:As circumstances change, it is essential to periodically review the policy to ensure it remains aligned with the key person’s needs and the business’s financial situation.

Ultimate Conclusion

Navigating the complexities of under a key person disability income policy premium payments can be daunting, but it doesn’t have to be. By understanding the ins and outs of this essential coverage, you can safeguard your business and its key individuals against life’s uncertainties.

Remember, a well-informed decision is a powerful tool in ensuring financial resilience.

Helpful Answers: Under A Key Person Disability Income Policy Premium Payments

What is a key person disability income policy?

A key person disability income policy provides financial protection to businesses in the event that a key employee becomes disabled and unable to work.

What factors influence premium payments?

Factors such as the employee’s age, health, occupation, and the policy’s coverage options can impact premium payments.

What coverage options are available?

Key person disability income policies offer a range of coverage options, including own-occupation and any-occupation coverage, with varying benefit periods and waiting periods.